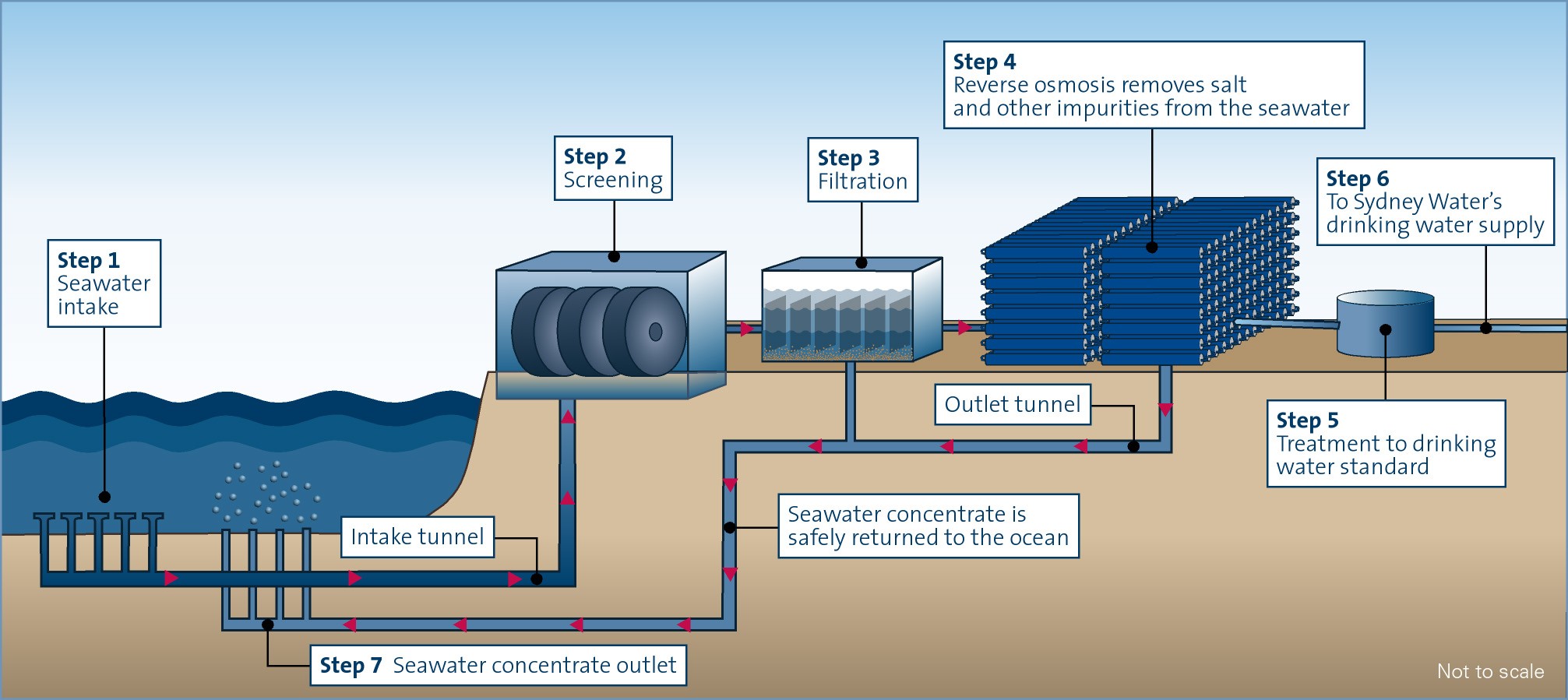

The Desalination Plant (located in Australia) was extensively damage by a tornado at the end of December of 2015. The plant uses reverse osmosis as its desalination method. Sea water is taken in from the nearby coast, treated, filtered and then it is pumped to pressures of approximately 50-60 bar before passing through the reverse osmosis membranes. The permeate is then treated to turn it into drinking water before it is pumped into the Sydney water supply pipe network.

The ‘heart’ of the plant is the reverse osmosis membranes (13 first pass trains, 7 second pass trains – over 36,000 membranes) which were housed in a single large building. It is this building that was the hardest hit by the tornado.

Desalination

The plant was in water security mode at the time of the incident, an operating mode where there was no production of water but where the plant could be called into full operation within 8 months. Thanks to this situation a business interruption loss never materialized.

Initial estimates of the loss were put at over AUD 900 million (property damage and business interruption combined) which was approximately USD 690million at the time.

A loss of this magnitude makes many Insurers nervous, and therefore Robertson and Co was asked to manage the loss in cooperation with Crawford and Co based locally in Australia.

Robertson and Co visited the site shortly after the event, it was clear from the site visit that the magnitude of the loss had been greatly overstated, however it was still a significant loss that was large enough to justify the implementation of the Loss Management Plan methodology. There was no need for a Common Cause Report as the cause of loss was storm damage.

Once the site visit and initial meetings with the Insured were completed we had a good understanding of their business, plant, production process and the kind and amount of manpower that would be needed to complete the activities required for a successful Loss Management Plan.

We presented the Agreed Scope of Damage/Priced Scope of Damage methodology to the Insured who understood and saw the value in the approach. The Insured however was a small company without the necessary resources to participate in the preparation of a full Scope of Damage, they therefore appointed their own third party engineers to work alongside Insurers engineers to prepare the scope of damage. The site was first divided into areas, determined by the severity of the damage and importance of the area to the process, it was then further divided into engineering disciplines (mechanical equipment, piping, civil works etc.). In the most important and severely damaged areas, all property was assessed and classified in accordance with Robertson and Co’s definitions. In the least affected areas only damaged property was recorded.

After the damage had been recorded and classified, both the Insureds’ and Insurers’ engineers as well as the Insured signed the scope of damage agreeing that it was an accurate reflection of the damage that had been measured and observed. This then formed the basis of the submission to contractors for the pricing of the repairs and reinstatement works required. We prepared Insurers requirements for the pricing and reinstatement activities and presented these requirements to both sets of contractors so that they would be quoting on the same conditions. With Insurers support, Robertson and Co have developed a specific set of contract conditions and requirements that reduce the risk of cost escalation and more importantly project delays. The most important of these is the separation of materials as reimbursable costs and services as a fixed lump sum.

Both sets of competing contractors were Tier 1 companies with excellent track records in large construction projects as well as relevant construction experience in desalination plants. The quotes were received and compared, these were within a few million of each other. However, the Insured’s choice of contractor was a little more expensive and had a longer reinstatement period. Insurers choice was a little cheaper and with a much more aggressive reinstatement period. The Insured expressed their desire to retain their chosen contractor despite the differences. Therefore, Insurers capped the reinstatement work to their contractors quote and reinstatement period, thus limiting Insurers exposure to escalation, increases in project costs or delays in construction.

Advanced funding was provided to the Insured and the project reinstatement works were started. The Insured grew confident that the project was running smoothly and recognized that Insurers further involvement was no longer necessary. They approached us and requested a full and final cash settlement for all remaining aspects of the loss.

A final settlement was agreed, and both Insurers and the Insured were very happy with the outcome of the loss. The cash settlement was achieved only 15 months after the date of loss.